Post Top Ad

Sunday, October 31, 2021

સરદાર વલ્લભભાઈ પટેલની જન્મજયંતિએ મોરબી સાથેનું સંભારણું

Monday, August 24, 2020

MIRACLE ACCOUNTING SOFTWARE Training session QUIZ

1. In general, the financial year shall be from *

1.

In general, the financial year shall be from *

A.

1st April of any year

B.

31st March of any year

C.

All of them are true

D.

None of these

2. Which menu appears after starting

Miracle for the first time? *

A.

M-Desktop

B.

Company List

C.

Company Info

D.

None of these

3. Which option is used to take the

company's backup into the pen drive? *

A.

Backup

B.

Restore

C.

Data Export

D.

Copy Data

4. Which menu is used to create new

ledgers, groups, and products in Miracle? *

A.

Report

B.

Import

C.

Transaction

D.

Master

5. Salary Account comes under which head *

A.

Income

B.

Fixed Assets

C.

Duties & Taxes

D.

Expense Account

6. Which ledger is created automatically as

soon as we create a new company? *

A.

Cash Account

B.

Profit & Loss A/c

C.

Stock in Hand

D.

All of above

7. Which voucher type is used to transfer

the amount from one bank to another? *

A.

Contra

B.

Payment

C.

Receipt

D.

Post-Dated

8. Rs. 50,000 withdrawn from the bank. In

which voucher type this transaction will

be recorded? *

A.

Payment

B.

Receipt

C.

Contra

D.

Post-Dated

9. Where do we record transactions of

salary, rent, or interest paid? *

A.

Contra

B.

Stock Journal

C.

Receipt

D.

Payment

10. Which option is true for viewing Profit

& Loss Statement? *

A.

Report> Balance sheet> Profit & Loss Statement

B.

Utility>Year-end> Profit & Loss Statement

C.

Report> Account Books > Profit & Loss Statement

D.

None of these

Test

11. Which step is followed to view Purchase

Register? *

A.

Transaction > Purchase Entry > Purchase Register

B.

Report > Outstanding > Purchase Register

C.

Report > Register > Purchase Register

D.

None of these

12. From which menu, we can see the Balance

Sheet option? *

A. Transaction

B. Report

C. Setup

D. Utility

13. Which option is used to view Product

Ledger? *

A. Purchase Register

B. Stock Report

C. Analysis Report

D. Account Books

14. Company Restore option is available in

*

A. Company List > Utility

B. Company List > Year

C. Company List > Advance. Option

D. None of these

15. "Alias" represents *

A. Short name

B. Nickname

C. Code name

D. All of these

16. Account statement can be displayed in

format(s). *

A. Horizontal

B. Vertical

C. A or B

D. None of the above

17. A 'credit note' is sent by to *

A. Seller, buyer

B. Buyer, seller

C. Customer, seller

D. Creditor, seller

18. Sales return are recorded in Voucher *

A. Bank Receipt Entry

B. Purchase Entry

C. Sales Entry

D. Sales Return Entry

19. Bank account is *

A. Personal account

B. Real account

C. Nominal account

D. Intangible real account

20. Taxes paid comes under which group *

A. Capital

B. Loans and liabilities

C. Direct expenses

D. Duties and taxes

21. Capital Account comes under which group

*

A. Capital account

B. Current Assets

C. Loans & Advances (Asset)

D. Current Liabilities

22. The shortcut used to activate the

Calculator is *

A. F9

B. F1

C. F3

D. F5

23. We can delete a voucher using *

A. Alt + Y

B. Ctrl + Y

C. Shift + Y

D. Ctrl + Shift + Y

24. Which shortcut key is used to take

print? *

A. Ctrl + P

B. Shift + P

C. Alt + P

D. Alt + Shift + P

25. Which shortcut key is used to see

Company Details? *

A. Ctrl + 0

B. Ctrl + P

C. Ctrl + D

D. None of above

26. Who is the Father of Accounting? *

A. The Divine Augustus

B. Leonardo Da Vinci

C. Luca Pacioli

D. None of above

27. The main type of account is *

A. Personal Account

B. Real Account

C. Nominal Account

D. All of above

28. How many companies can be created in

Miracle? *

B. 999

C. 9999

D. 99999

29. Which shortcut key is used to create a

new Account/Product in the master

menu? *

A. F2

B. F3

C. F9

D. Insert

30. Which shortcut key is used to Copy

Voucher? *

A. Ctrl + V

B. Ctrl + C

C. Ctrl + A

D. Ctrl + S

SUBMIT FORM

Thursday, August 13, 2020

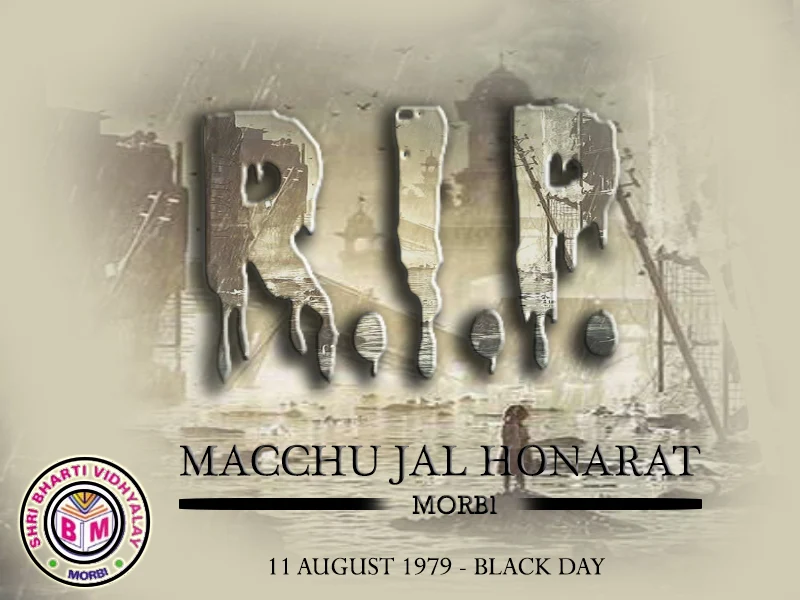

11 august,1979: The Black Day for morbi ( Macchu Dam Honarat )

11 august black day for morbi. one of the biggest disasters in Gujarat whare around 10000 people died and hundreds of people are still missing here is the full history of Macchu dam disaster (honarat)

History of morbi Macchu Dam Honarat (disaster)

On August 10, 1979, rainstorm storms poured over Gujarat, India. Tempest rainstorms were ordinary in this bit of India, anyway as the storm extended it was clear this was greater than the commonplace whirlwind. The stream began to augment down the Machhu stream, first hitting Machhu Dam I and a short time later going downstream to Machhu Dam II. As the storm heightened, overseers at the Machhu Dam II began to open portals to shield the dam from rising above the most outrageous levels. By 1:30 AM all the passages were opened totally beside three entryways that were not properly working. Regardless of the nonoperational portals the dam was passing 196,000 cubic feet for consistently (CFS), extraordinarily close to its full restrain of 200,000 CFS. It wasn't adequate, and the water continued rising. It was an early night on August 11, 1979, when water overtopped the earthen barriers on the different sides of the stonework spillway provoking the mistake of Machhu Dam II.

A piece of advice had been passed on through the All-India Radio impart around early evening time teaching people to move to higher ground considering potential issues at the dam. In any case, correspondence from the dam site had failed and no official caution of the dam frustration was given. Around 90,000 segments of land feet of water joined the viably considerable stream from the stream and rushed into the unassuming network of Lilapar thoroughly drenching all the structures in the town. Luckily, the people of Lilapar had, by and large, focused on the early notification.

Of course, relatively few in the significantly greater town of Morbi offered notice to the notification. Flooding during the tempest season was ordinary and various people acknowledged this flood would not be totally different than past floods and fail to understand the degree of the catastrophe. Thusly, many would not satisfactory, or didn't void to adequately high ground. In Vajepar, a country organizes on Morbi's edges, people cleared to the close by asylum since it had been out of the submersion locale of the last immense flood. Water rushed into the asylum making an escape from freakish and killing more than 100 people. The flood wave by then pushed on to Morbi where it wrecked structures, executed tamed creatures, and took lives. No one knows unmistakably what number of lives were lost, yet assesses go from 1,800 to as high as 25,000. Some bit of the clarification the number moves so much is that colossal mass graves were seared to shield diseases from spreading before genuine records or any conspicuous confirmation could be done.

An official government demand was accumulated to choose the purpose behind the mistake. The organization itself quickly put forward that the flood was past whatever the state of the preparation would have required and that the flood that was more than numerous occasions as far as possible was not unsurprising. The primary authority would not certify, and the organization disbanded the solicitation before they completed any report.

There was a report completed on the failure of the dam by Dr. Y. K. Murthy in 1985. While his measure of the zenith inflow at 460,000 CFS isn't actually the organization checks, which expand someplace in the scope of 630,000 and 936,000 CFS, he agreed that overtopping of the dam that singular had a spillway cutoff of 200,000 CFS was unpreventable. He also agreed that the spillway structure breaking point of 200,000 CFS was according to the state of the preparation for that time span.

Machhu Dam II was in the long run adjusted with a spillway cutoff of 872,000 CFS and was done in 1989. Today is so far in movement.

No One Had a Tongue to Speak: The Untold Story of One of History's DeadliestFloods book written by Utpal Sandesara, Tom Wooten had mentioned Macchu dam disaster in a great way every morbi people must read this book you can purchase this book from below.

Get GST application approval within 3 days : Know how Deemed approved section Section 25(10) works?

Deemed approval for GST

registration:

if

the assessing officer fails to take any action on the GST registration

application and the following application shows pending for processing status

it will be auto-approved as per GST law. due to COVID auto-approved system is

on being halt till 1st august.

·

important announcement as on17 July

1.

an application which was

done before 31june and pending till 15 July will get deemed approval

2.

application received

after the following date will get deemed approved as on 31 July.

The GST (GST) the affiliation has lifted a limitation on respected guaranteeing for new

enlistments, which was obliged during the lockdown time range for dread that

the working environment could be abused without appropriately working GST

divisions the nation over. A few states had revealed the case of starting late

selected affiliations being occupied with backhanded exchanging during the

lockdown.

For enlisting as a

GST business, an occupant needs to record an application on the GST Network

section. This application is then distributed to either the focal or state

charge pros relying on the wards. As appeared by the law, the authority would

process the application in three working days at any rate if no move is made,

the indistinguishable is regarded to be grasped.

As per Section 25(10) The GST framework

wing permitted decides seven days back that all enrollment applications as on

June 30 that have stayed pending till July 15 be yielded seen as guaranteed.

Further, applications got post-June 30 and pending till July 28 would be

regarded held onto too.

The course besides

said that by virtue of specific glitches in GSTN, barely any determination

applications were affirmed in any case, during the lockdown when the work

environment had been pulled back. "GSTN has been referenced to advance

such GSTINs who got respected guaranteeing during the lockdown to the

jurisdictional specialists. In such cases, any place required, legitimate

specialists may get the physical check of the premises done," the letter

said.

During the

lockdown time range, different affiliations had seen long suspensions in

getting their GST determination demanded, and found no assistance on raising

the issues with the specialists. Most such issues were for applications

submitted in April and May.

A state charge the official said that state's business charge division had discovered two or three

instances of roundabout exchanging – which included affiliations giving phony

mentioning among one another to misleadingly benefit input charge credit

without certified agilely of things and undertakings – with overpowering the excitement from affiliations enlisted during the lockdown.

"Examination aces

saw an abrupt flood in GST selections during the pandemic timespan, paying

little heed to the way that other monetary markers like e-way charges, charge

mixes and GDP crushed. Since lockdown is fundamentally over in all states,

process for respected endorsing of use for selection would be continued from

August 1," Rajat Mohan, senior frill at AMRG and Associates, said.

Wednesday, August 28, 2019

How GST makes impect to Morbi Ceramic Industry

Impact on ceramic Tiles industries

The goods and service tax impact on ceramic tiles is essentially neither an excessive amount of high nor fully relaxed. Somany Ceramics Ltd., that is taken into account India’s third largest tile manufacturer, said that, even once the reduction in tax rates on tiles, the corporate isn't expecting the disturbance created by the products and Services Tax (GST) to relax within the last half of the year. GST on tiles is being levied at 18 %.

After the implementation of goods and Services Tax (GST) Regime, the advanced rules and measures of recent revenue enhancement reform are influencing the key activities of the tiles trade. Abhishek Somany, administrator of Somany Ceramic Tiles, said, “The 1st six months were a whole washout.”

“GST rate on tiles had been slashed by the Council from twenty eight % to eighteen % on fifteenth November 2017. The lower tax rates wouldn't be helpful to spice up the revenue growth within the last half of FY. the type of wind that we might have felt because of the speed cut won't be fully seen,” same the corporate. because of the postponement of the implementation of e- way bills is another major disadvantage that is influencing the tiles industries. associate e-way bill is associate electronic invoice which will be utilized in transporting product from one place to a different.

According to securities firm edelweiss, it's anticipated that the tiles manufacturer can gain a 16.5 % combined revenue growth annually. the corporate disagreed with this and same that there's a necessity to feature a lot of product to the road that helps to reinforce the expansion of the corporate by FY 2019.

The company same that it outsourced 40 % of producing from alternative states and it's anticipated to keep up outsourcing within the following two-three years.

Imper